Retail | CA | CDTFA Delivery Tax Rates

Starting 1/1/2024 California delivery sales and use taxes will be based on the City, County and Zip code where the delivery occurs (not where the retail operation is located)

Disclaimer: BLAZE provides best-effort support for the CDTFA connection and will save past results where possible to increase reliability.

The CDTFA has specifically informed us that their connection has “no guarantee of up-time. Sometimes there are outages due to software updates, data changes, or infrastructure changes.”

In the event the connection is unavailable and there is not cached response for that region, we will fall back on the manually entered tax rate in the State Tax field.

Delivery operators now have the ability to toggle this option within their Tax Options & Delivery Tax Option settings to pull the applicable tax rates directly from the CDTFA.

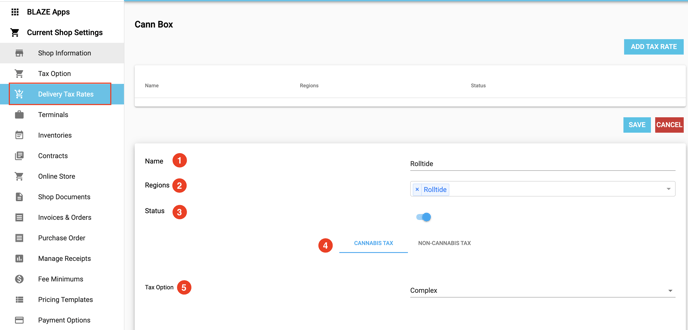

Delivery Tax Rates Settings

Navigate to your Global Settings > Current Shop Settings > Delivery Tax Rates

1. Name - name of your region

2. Regions - select your region(s)

*If not regions are created, create them in your Company Settings > Regions

3. Status - Enable toggle to active

4. Cannabis Tax - Select

5. Tax Option - Select Complex

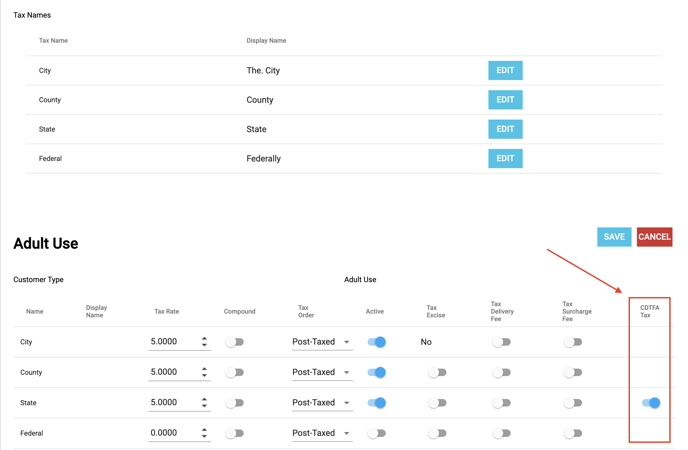

CDTFA Tax

By enabling the CDTFA Tax option for the State tax rate, this will pull the applicable tax rates directly from the CDTFA.

NOTE: Ensure each applicable tax line is set to active with tax rate value entered.