Retail | Illinois Adult Use Tax Rate Setup

Illinois charges tax based on the THC percentage of the product. Below are the steps to apply these tax rates to the products in BLAZE

There are 3 separate tax rates for inventory and each of these is linked to

different product types:

|

Rate Type |

Rate |

Associated Inventory Types |

|

High THC – Above 35% THC. |

30% |

• Usable Marijuana • Marijuana Mix Packaged |

|

Low THC - Below 35% THC. |

10% |

• Usable Marijuana • Marijuana Mix Packaged |

|

Other – All cannabis infused inventory items. |

20% |

• Solid Marijuana Infused Edible • Liquid Marijuana Infused Edible • Marijuana Infused Topical • Marij There are 3 separate tax rates for inventory and each of these is linked to uana Extract for Inhalation • Marijuana Mix Infused • RSO |

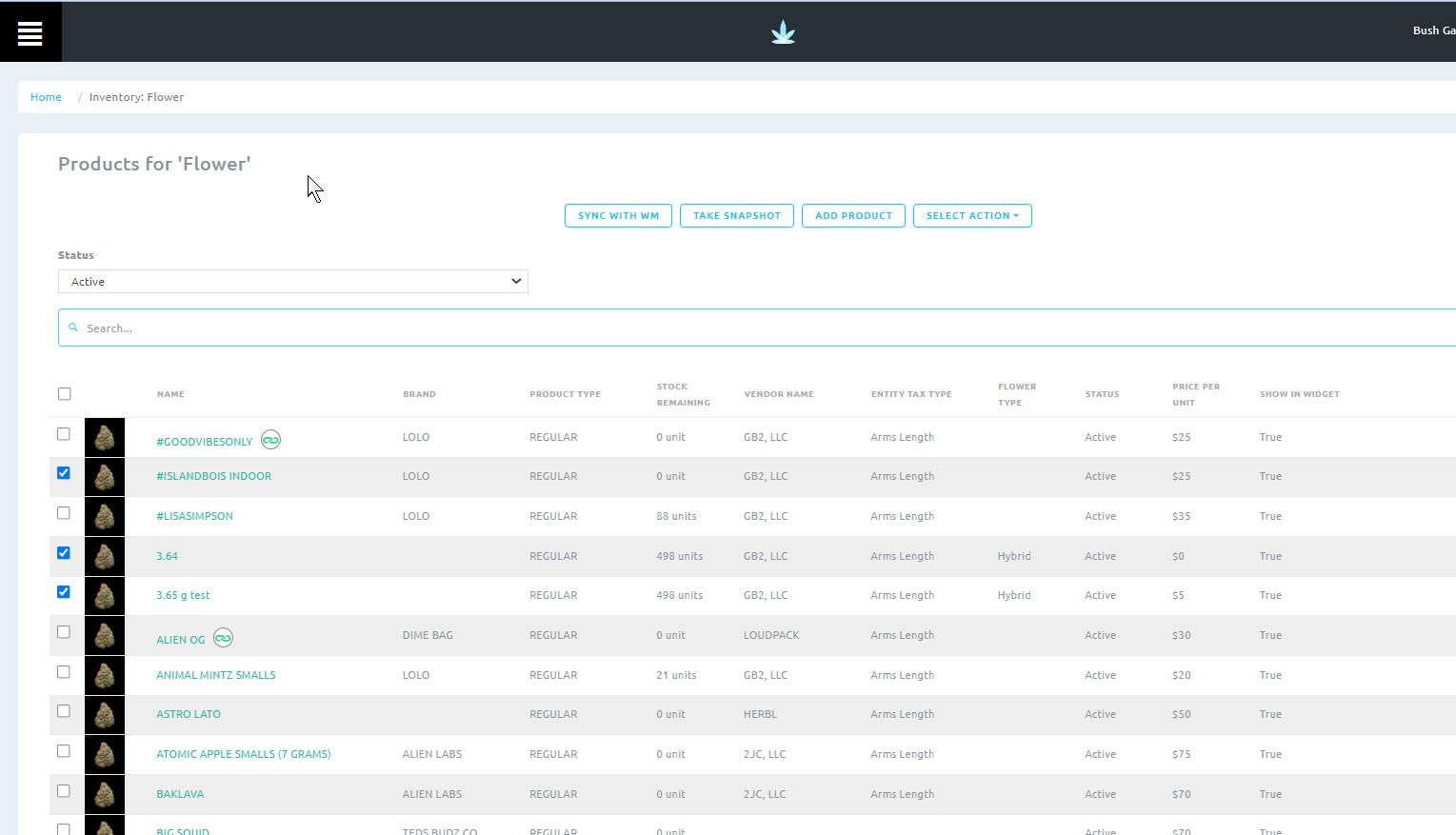

Bulk Update for Multiple Products

1. Go To Retail > Inventory > Select the Category

2. Select the products that this rate will apply to

3. Click on the Select Action button

4. Click on Edit Tax

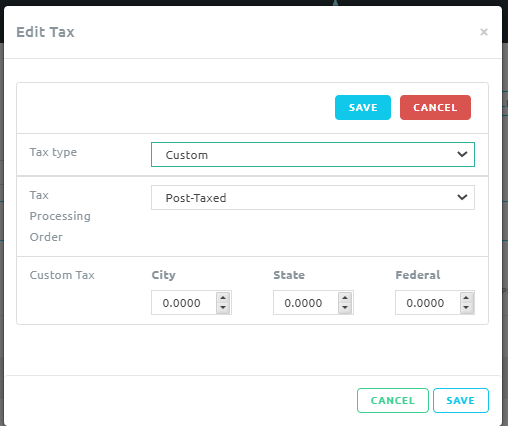

5. Click on the Edit Button

6. Click on Tax Type and select Custom

7. Select the Tax Processing Order: Pre-Taxed or Post-Taxed

8. Enter the rate in the City, State or Federal box

9. Click Save

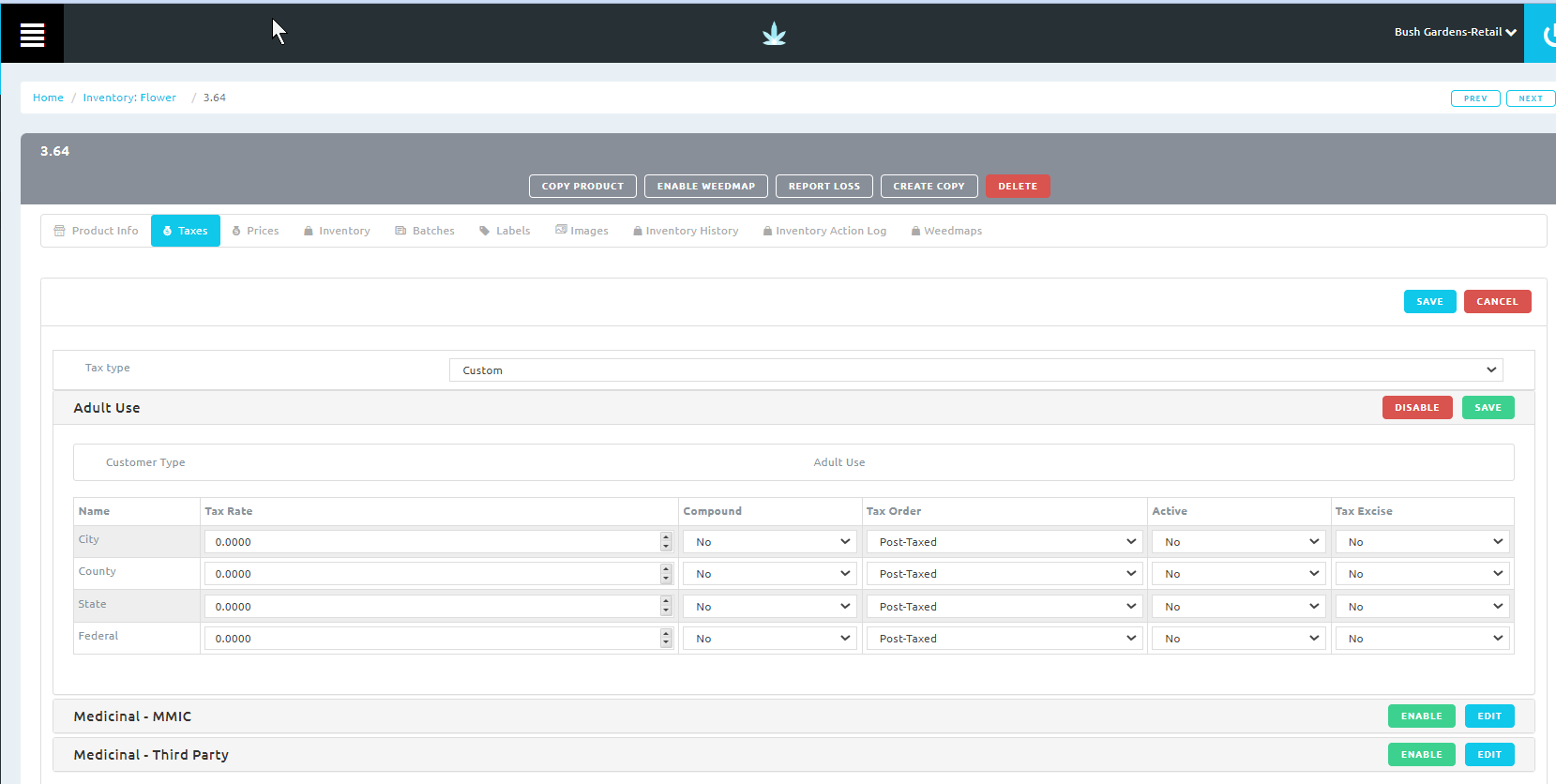

Single Product Update

1. Go To Retail > Inventory > All

2. Select your product

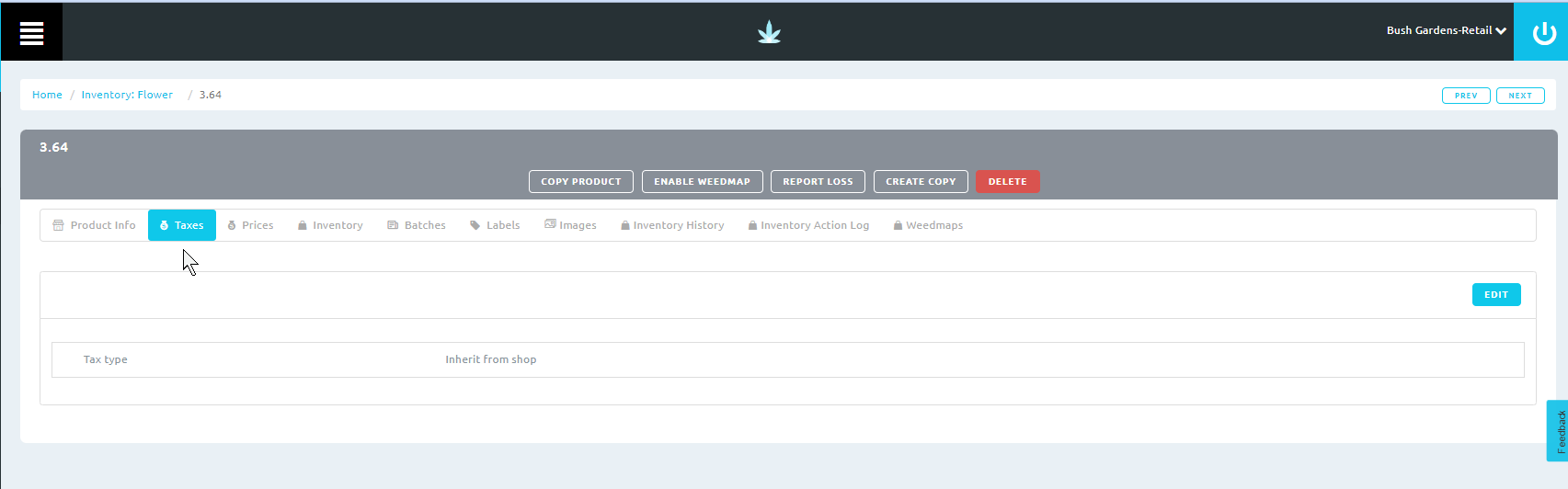

3. Click on the Taxes Tab

4. Click Edit

5. Click on the Tax Type and select Custom

6. In Adult Use, click on Edit

7. Enter the appropriate tax rate on the corresponding line for this product based on the table above.

- Compound: Select Yes or No

- Tax Order: Select if this tax is Pre Taxed or Post Taxed

- Active: Set this tax rate to Yes to activate it

- Tax Excise: Select Yes or No

8. Click Enable

9. Click Save

10. Repeat as necessary for Medicinal - MMIC and Medicinal - Third Party