Post-Tax vs Pre-Tax

These settings are effective January 1, 2023

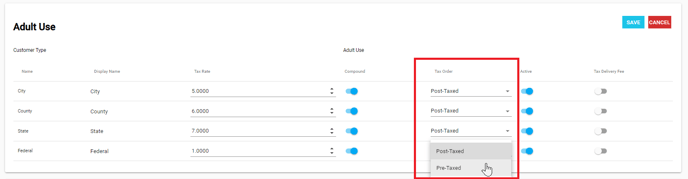

There are two ways your specified tax rates can be calculated within your transactions.

- Post-Tax

- Pre-Tax

- NOTE: For states outside of California, excise taxes will be set within the Tax Options as a normal line item tax where they can then be set to either pre-tax or post-tax.

Your tax option will default as a "post-tax" calculation, meaning the rates will be added to the final subtotal. After taxes are calculated, there will be a new final total.

The pre-tax option will still calculate a value based on the specific rates, but NOT affect the final subtotal. With this option enabled, BLAZE will reverse engineer the applicable tax rates starting from the final total.

It is important to remember that the order/sequence the rates are calculated will start at the top and finish at the bottom.

- EX: City > County > State > Federal

- NOTE: This is if the "tax option" is set to "complex"

OR

- EX: City > State > Federal

- NOTE: This is if the "tax option" is set to "regular"

Always run a test transaction to test your tax rates, to ensure you get the calculations you want.

***Always consult a Professional / CPA / Attorney, before setting / changing your taxes ***

BLAZE® is a complex and sophisticated SaaS platform that provides a series of individual tax settings for each client customer, subject to the advice of their tax advisor professional that enables the client customer to comply with local, state, and national governmental tax schemes. YOU ARE SOLELY RESPONSIBLE FOR YOUR TAX SETTINGS. TAX RATES, NAMING CONVENTIONS AND THE ORDER OF OPERATION FOR THOSE RATES VARY BY JURISDICTION AND ARE SUBJECT TO CHANGE. YOU AND YOUR TAX PROFESSIONAL ARE RESPONSIBLE FOR REVIEWING, UPDATING, AND APPLYING THE SPECIFIC TAX SETTINGS, RATES AND THE ORDER OF OPERATION FOR YOUR SERVICE AREA(S). THE COLLECTION, RETENTION, AND PAYMENT OF APPLICABLE TAX LIABILITIES TO APPROPRIATE AUTHORITIES IS YOUR SOLE RESPONSIBILITY. BLAZE® MAKES NO WARRANTY NOR REPRESENTATION THE TAX SETTINGS, RATES AND THE ORDER OF OPERATION YOU SELECT ARE APPROPRIATE AND CORRECT. YOU EXPRESSLY AGREE BLAZE® SHALL NOT HAVE ANY LIABILITY FOR UNDER OR OVERCOLLECTION OF YOUR TAX LIABILITIES BASED UPON THE SETTINGS YOU SELECT.