Retail | CA | Taxing of surcharges and fees

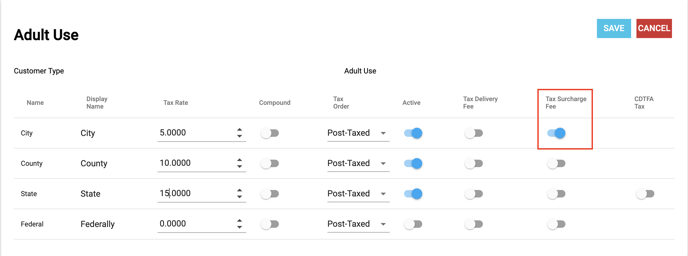

California clients who wish to collect the applicable tax from their customers should enable the Tax Surcharge Fee option.

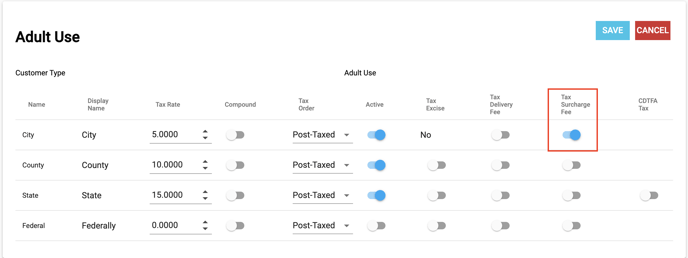

We have added the option to toggle on 'Tax Surcharge Fee' within your Tax Options settings. Per the CDTFA guidelines, these fees are included in your “Gross Receipts” and are subject to CA State Sales tax calculations. California clients who wish to collect the applicable tax from their customers should activate this option.

*NOTE: Tax Surcharge Fees when enabled are only applicable to what is set up in your

Fee Minimum settings.

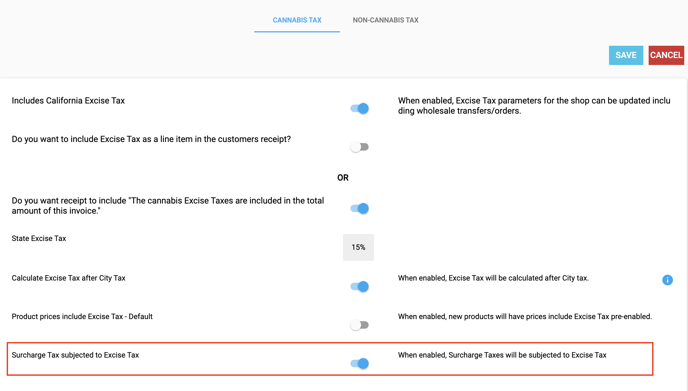

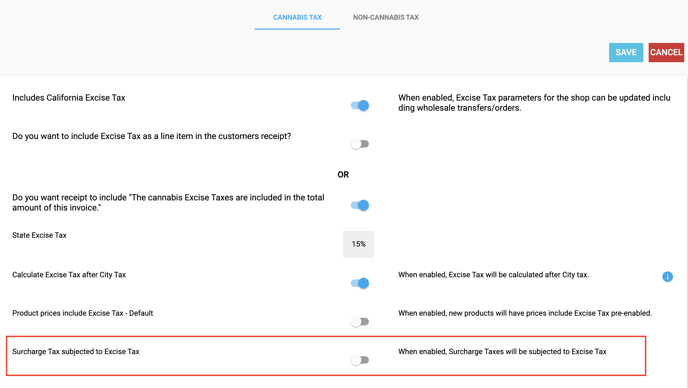

Cannabis Tax

Surcharge Tax subjected to Excise Tax

-

When enabled, Surcharge Taxes will be subjected to Excise Tax

Example Configuration

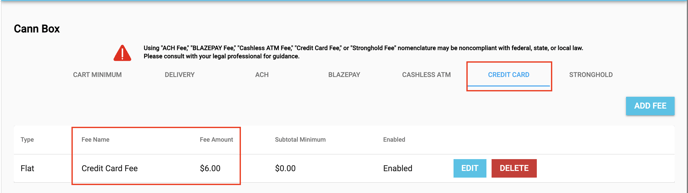

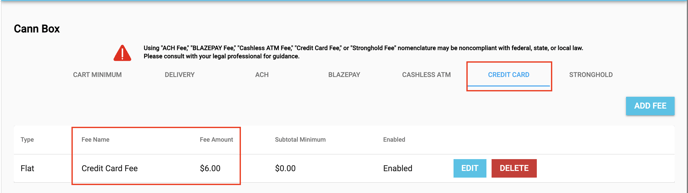

1. Set up Fee Minimums in your global settings to apply the Surcharge Tax.

Example here is credit card fee of $6

2. Configure Tax Options 'Calculate surcharge fee tax before excise tax'

*When enabled, Surcharge Taxes will be subjected to Excise Tax

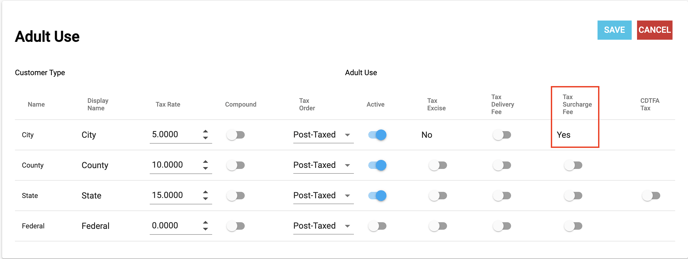

3. Tax Surcharge Fee - When enabled per tax line, the surcharge fee will be taxed according to the tax rate set.

Example:

A) Credit card fee = $6

B) City tax rate = 5%

C) Surcharge fee tax = $6 x 5% = $.30 (Included in the total individual tax per line)

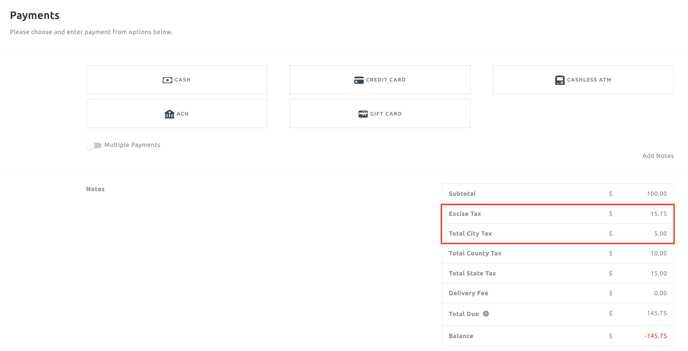

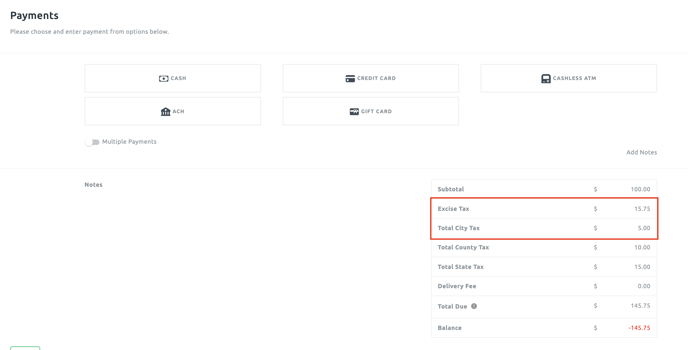

4. Totals breakdown when processing a transaction before the payment type is applied.

Example below is displaying the city tax and excise tax prior to selecting the payment method and before surcharge calculations.

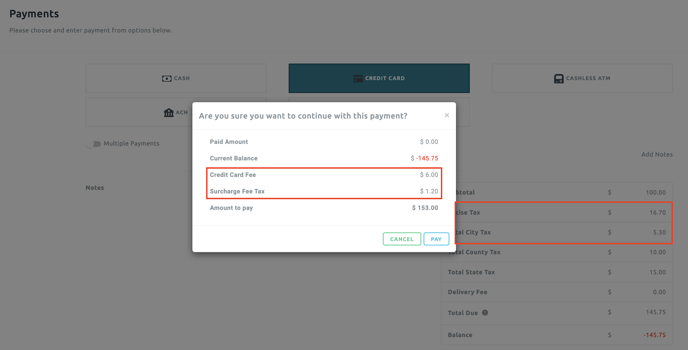

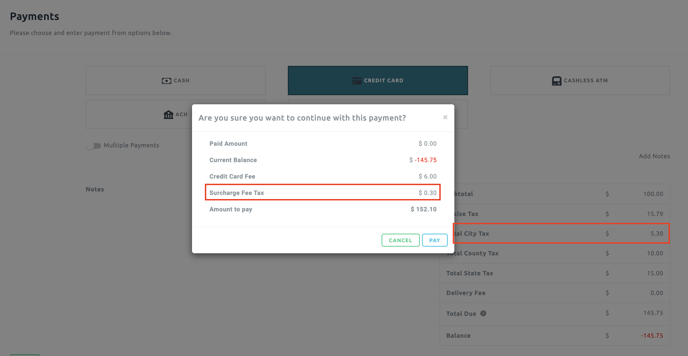

5. After payment option is selected the surcharge fee tax will be calculated.

Example below we have a credit card fee of $6.

Order of calculations:

A) City Tax:

Credit card fee ($6) x city tax rate (5%) = surcharge fee tax ($.30)

New total city tax = ($5.30)

B) Excise tax:

Subtotal ($100) + city tax with surcharge tax ($5.30) + Fee ($6) x Excise (15%) =

Total Excise ($16.70)

C) Surcharge fee tax = $1.20

Disabled | Surcharge Tax subjected to Excise Tax | Example Configuration

*Disable this setting option if you do not want the surcharge fee tax subjected to excise tax.

1. Set up Fee Minimums in your Global Settings to apply the Surcharge Tax.

Example here is credit card fee of $6

2. Configure Tax Options and disable 'Surcharge Tax subjected to Excise Tax'

3. Edit the consumer type to enable the 'tax surcharge fee' per line.

Example below we have enabled the the tax surcharge fee for the city tax rate.

4. Totals breakdown when processing a transaction before the payment type is applied.

Example below is displaying the city tax and excise tax prior to selecting the payment method and before surcharge calculations.

5. After payment option is selected and calculating the surcharge tax.

Example below we used credit card which has a fee of $6.

Order of calculations:

A) City Tax Rate:

Credit card fee ($6) x tax rate (5%) = $.30 {New city tax = $5.30}

B) Excise Tax:

Subtotal ($100) + new city tax ($5.30) x Excise tax (15%) =

new total excise tax ($15.79)

C) Surcharge Fee Tax:

Difference of pre city tax ($5) and new city tax with surcharge fee tax ($5.30) =

Surcharge fee tax ($.30)

Non-Cannabis Tax

Excise tax options will not be applicable and will only have the option to configure 'Tax Surcharge Fee' per tax line.