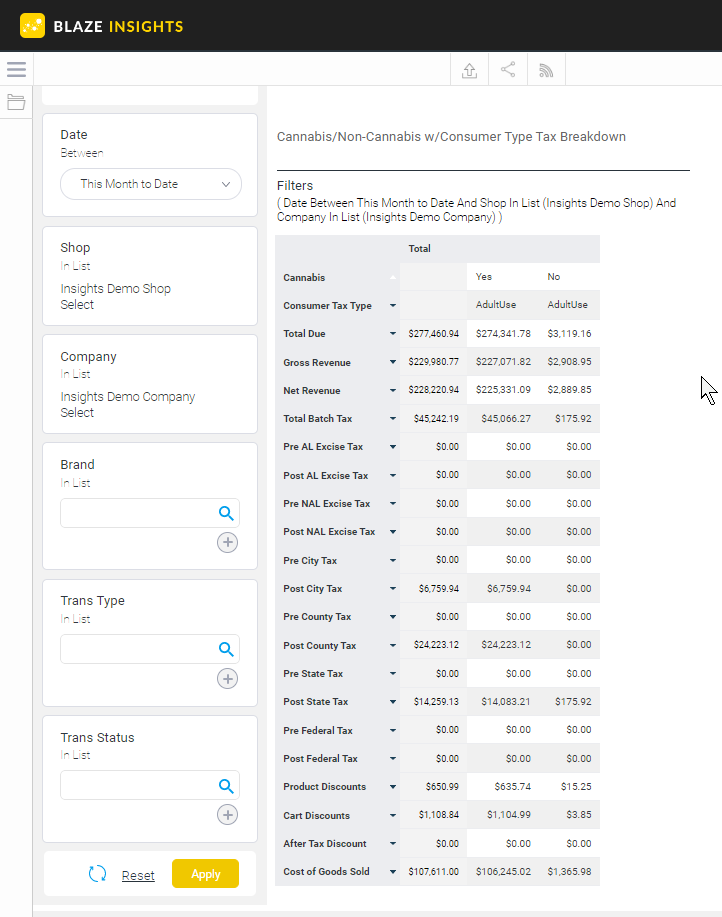

This report provides you with the Summary of Cannabis/Non-cannabis taxes and sales totals with Consumer Types.

- Blaze Insights > Browse > Reports > Insights (Standard) > Accounting

- Enter the Date range

- Select the Shop or Shops to include in this report

- Select the Company

- Select the Transaction Type if you are looking for a specific Transaction

- Select the Transaction Status if you are looking for a specific Transaction Status, In Progress, Hold, or Completed.

- Click Apply

The following summary information is contained in this report

- Cannabis : Cannabis or Non-Cannabis

- Consumer Tax Type: This will display the Consumer type for each column.

- Total Due: Total tax due.

- Gross Revenue: multiplying the retail value of the product sold without discounts, taxes, or fees by quantity sold.

- Net Revenue: Gross Revenue - Pre-Tax Discounts + Delivery Fees (split per weighted price)

- Total Batch Tax: All Excise Taxes + All City/County/State/Federal taxes.

- Pre AL Excise Tax: Total of excise pre-taxes applied for AL (Arms Length) sales.

NOTE: The vendor of the product determines whether AL or NAL excise tax is applied.

- Post AL Excise Tax: Total of excise post-taxes applied for AL (Arms Length) sales.

- Pre NAL Excise Tax: Total of excise pre-taxes applied for NAL (Non-Arms Length) sales.

- NOTE: The vendor of the product determines whether AL or NAL excise tax is applied.

- Post NAL Excise Tax: Total of excise post-taxes applied for NAL (Non-Arms Length) sales.

- Pre City Tax: Total of city pre-taxes applied.

- Post City Tax: Total of city post-taxes applied

- Pre County Tax: Total of county pre-taxes applied.

- Post County Tax: Total of county post-taxes applied.

- Pre State Tax: Total of state pre-taxes applied.

- Post State Tax: Total of state post-taxes applied.

- Pre Federal Tax: Total of federal pre-taxes applied.

- Post Federal Tax: Total of federal post-taxes applied.

- Product Discounts: Total amount of product discounts

- Cart Discounts: Total amount of cart discounts

- After Tax Discounts: Total amount of After Tax Discounts

- Cost of Goods Sold: Total amount of the Cost of Goods Sold. To calculate this, BLAZE uses the batch COG on a unit level and applies it to the quantity being purchased by the customer to get COGS. This does not include excise tax, excise tax is a separate line item.

NOTE: Reference this link for common definitions and calculations.