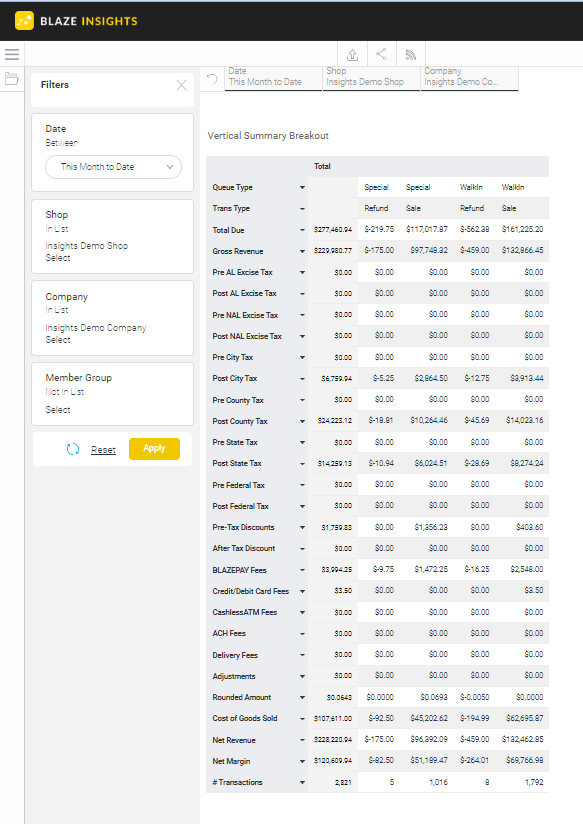

This report provides you with the Vertical Summary Breakout of the sales totals.

- Blaze Insights > Browse > Reports > Insights (Standard) > Accounting

- Enter the Date range

- Select the Shop or Shops to include in this report

- Select the Company

- Select the member Group if desired

- Click Apply

The following summary information is contained in this report

- Queue Type: Totals by Queue

- Trans Type: Transaction Type

- Total Due: Net Revenue + Total Tax (Post Taxes Only) - After Tax Discount + Payment Fees (ACH, CC, BLAZEPay, etc) + Adjustments + Rounding.

- Gross Revenue: multiplying the retail value of the product sold without discounts, taxes, or fees by quantity sold.

- Pre AL Excise Tax: Total of excise pre-taxes applied for AL (Arms Length) sales.

- NOTE: The vendor of the product determines whether AL or NAL excise tax is applied.

- Post AL Excise Tax: Total of excise post-taxes applied for AL (Arms Length) sales.

- Pre NAL Excise Tax: Total of excise pre-taxes applied for NAL (Non-Arms Length) sales.

- NOTE: The vendor of the product determines whether AL or NAL excise tax is applied.

- Post NAL Excise Tax: Total of excise post-taxes applied for NAL (Non-Arms Length) sales.

- Pre City Tax: Total of city pre-taxes applied.

- Post City Tax: Total of city post-taxes applied

- Pre County Tax: Total of county pre-taxes applied.

- Post County Tax: Total of county post-taxes applied.

- Pre State Tax: Total of state pre-taxes applied.

- Post State Tax: Total of state post-taxes applied.

- Pre Federal Tax: Total of federal pre-taxes applied.

- Post Federal Tax: Total of federal post-taxes applied.

- Pre-Tax Discounts: Total amount of Pre-Tax Discounts

- After Tax Discounts: Total amount of After Tax Discounts

- BLAZEPAY Fees: Total BLAZEPAY Fee

- Credit/Debit Card Fees: Total Credit/Debit Card fees

- ACH Fees: Total ACH Fees

- Delivery Fees: Total Delivery fees

- Adjustments: Total Adjustments

- Rounded Amount:

- Cost of Goods Sold: Total amount of the Cost of Goods Sold. To calculate this, BLAZE uses the batch COG on a unit level and applies it to the quantity being purchased by the customer to get COGS. This does not include excise tax; excise tax is a separate line item.

- Net Revenue: Gross Revenue - Pre-Tax Discounts + Delivery Fees (split per weighted price)

- Net Margin: Net Revenue - Cost of Goods Sold

- # Transactions: Total number of transactions for the filters selected

NOTE: Reference this link for common definitions and calculations.