This SOP will guide you through the following topics: Understanding Merchant Fee vs Consumer Fee, Interchange Fees, where they come from & how to estimate them, Bank Deposit Timeline, and Comparing your Bank deposits to your BLAZEPAY Report.

Understanding Merchant Fee vs Consumer Fee

There is a definitive difference between the fees that you are charged as a dispensary, and the fees you choose to charge your consumers to use Pin Debit.

Merchant Fees

Merchant Fees are the fees that the payment processor charges you, the merchant, for each transaction. These fees are dictated by, controlled by, and applied by the payment processor for your payment program. These fees are not currently displayed inside of BLAZE. Lower in this document we will discuss how to calculate the best possible estimate of Merchant Fees that you will be charged when doing reconciliation.

Consumer Fees

Consumer Fees are the fees that you, the merchant, charge your consumers on top of their order total when they use Pin Debit. These fees are collected along-side the order totals and are considered revenue. Lower in this document we will discuss where these fees end up in your bank deposits when doing reconciliation

Interchange Fees, where they come from & how to estimate them

Interchange fees are transaction fees that your (i.e. the merchant) bank account must pay whenever a customer uses a debit card to make a purchase from your store. The fees are paid to the card-issuing bank to cover handling costs, fraud, and bad debt costs and the risk involved in approving the payment.

Interchange fees are variable and can depend on the issuing card network (Visa, Mastercard, etc) as well as the card’s issuing bank. We will discuss how to estimate these fees lower in this document but we have found that for debit transactions, an average of between 0.5% and 0.7% is a pretty confident estimate of what you can expect. Just like Merchant Fees above, these fees are currently not stored in BLAZE due to the nature under which they are applied by the issuer.

Bank Deposit Timeline

BLAZEPAY Pin Debit has two options for bank deposit cadence, each with pros and cons. The determining factor of your deposit cadence is what time of day your card readers batch out. This can be decided at the point of onboarding, as well as changed afterwards upon advance request.

- Standard deposit timeline (2 business days)

- Next-day deposit timeline

Standard Deposit Timeline

The most common deposit timeline is a 2 business day delay. If you have your card readers batching at the end of the night after business hours, the entire day of transactions will batch in a single deposit and enter into your bank account 2 business days later as a lump sum. As an example, your transactions that you process on Monday will be deposited Wednesday in full.

The advantage of this method is that your deposits happen in full per-day batches. This makes your settlements easier to reconcile. The disadvantage of this method is that your settled amount is deposited in 2 business days as opposed to next-day.

Next-day Deposit Timeline

Some merchants choose to opt for Next-day deposits. If you have your card readers batching prior to 6pm EST, the funds from all of the transactions that happened up to that point in the day will deposit into your bank account the next business day. As an example, your transactions that you process on Monday before 6pm EST will be deposited Tuesday.

The pro of this method is that your deposits happen one business day after they are processed, the con is that only the transactions before 6pm EST get deposited the next day, and anything after that time of day still adheres to the 2 business day delay which can cause additional reconciliation time.

Comparing your Bank deposits to your BLAZEPAY Report

If you are trying to compare your Bank deposits to your BLAZE data, the best report to use is the BLAZEPAY Report

Retail | BLAZEPAY Report

To access the BLAZEPAY Report, navigate to the Data Export tab

Select the Transactions tab, then select the BLAZEPAY Report

From the BLAZEPAY Report you can filter dates as needed and select Update

To download the report, select Download

Once you have your BLAZEPAY report exported you can compare it to your Bank statements, keeping your deposit timeline method in-mind. Lets work through the reconciliation of 1 day’s deposit and fees.

In this example, on the 7th of December there were two line items in the Bank statement - a deposit and a withdrawal.

The deposit is the amount collected by the card readers in full, and the withdrawal is a combination of the Merchant & Interchange fees for those transactions. This merchant uses the standard full-day deposits with a 2-day delay. This means the transactions attributed to this deposit happened on the 5th. First lets focus on reconciling the deposit without the fees Let's look at the BLAZEPAY report for the 5th:

Here we see both order amount and Fees (consumer fees) added together form the $123 deposit from the bank statement. This is because the consumer fees you collect count as revenue generated from the card readers. Next let's look at reconciling the merchant fees debited from your bank account.

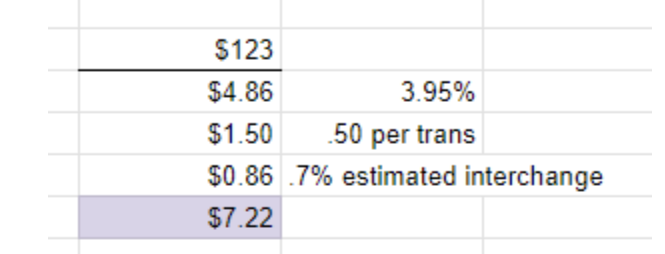

Merchant fees are calculated off the deposit line, in a number of ways that sum together. You have your non-changing merchant fees and then you have variable interchange fees that we can estimate with a high level of accuracy. In this example we see the following:

- Merchant Fee = 3.95% + $0.50 of each transaction

- Interchange Fee = Estimate of 0.7%

With this calculation we are only 1 penny off of the actual fee debited from the bank account, and that is simply because interchange is variable per transaction so when we calculate we are using an approximate average fee percentage.

Using the above information, you can simply line up each deposit with each day of transactions in your BLAZEPAY report!

If you require additional assistance please contact pay-support@blaze.me