Cannabis Retailers "in select states" must collect an excise tax from their customers.

Please consult with your Tax Professionals when configuring BLAZE to your specific needs.

Here is a list of states that currently have excise taxes as a part of their taxes:

These settings were only effective through December 31, 2022. New Excise Tax settings were effective on January 1, 2023. For California Excise Tax setting see this document.

For all other states, see this document.

- California

- Colorado

- Michigan

- Alaska

- Massachusetts

- Hawaii

- Missouri

- Nevada

- New York

- Oklahoma

- Pennsylvania

- Washington

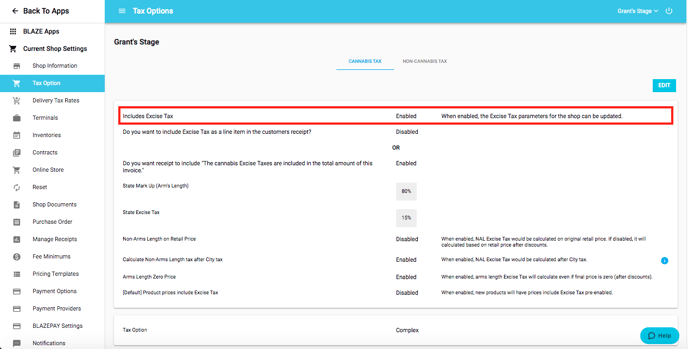

If you have the "Excise Taxes" enabled, BLAZE will calculate these values for you based on your specific state's regulations. These calculations can be found in a few different places:

- Purchase Orders

- Receive Metrc Transfers

- Batch Details

- Transaction Details

As operators, you can include these taxes in your listed "Retail Price" or not. Turning on the setting "[Default] Price includes excise tax" will be auto-enabled for all newly created products. You will want to confirm that this setting is also "enabled" through the individual products' profile. If this setting is enabled, your excise tax calculation will be displayed in parenthesis "(x.xx)."

Depending on your preferences/settings with including the taxes, you might need to visit the "Manage Receipts" section in your Current Shop Settings.

NOTE: The Includes Excise Tax setting in the Tax Options will only pertain to shops in California.

Within California shops, products that are non-arms length (NAL) can either calculate to include city taxes within the NAL excise tax calculations OR calculate NAL excise taxes only on the subtotal via the Calculate Non-Arms Length tax after City tax setting (Global Settings > Tax Options).

Enabling this setting will calculate your NAL product's taxes in this order:

- City > NAL Excise > County > State > Federal

- NOTE: This is if the "tax option" is set to "complex"

OR

-

City > NAL Excise > State > Federal

NOTE: This is if the "tax option" is set to "regular"

Disabling this setting will calculate your NAL product's taxes in this order:

-

NAL Excise > City > County > State > Federal

NOTE: This is if the "tax option" is set to "complex"

OR

-

NAL Excise > City > State > Federal

NOTE: This is if the "tax option" is set to "regular"

.png?width=688&height=332&name=Taxarticle_%20(2).png)

NOTE: For California shops, if Calculate Non-Arms Length tax after City tax is enabled, City Taxes MUST match the settings from within the product profile of NAL products.

EX: If your NAL product is set to:

- Price Includes Excise is set to yes (pre-tax), then the City tax's tax order must also be set to pre-tax (Global Settings > Tax Options).

- Price Includes Excise is set to no (post-tax), then the City Tax's tax order must also be set to post-tax (Global Settings > Tax Options).

- These settings must only match when the Calculate Non-Arms Length tax after City tax setting is Enabled. If the Calculate Non-Arms Length tax after City tax setting is Disabled, then these setting will not need to align.

***Always consult a Professional / CPA / Attorney, before setting / changing your taxes ***

BLAZE® is a complex and sophisticated SaaS platform that provides a series of individual tax settings for each client customer, subject to the advice of their tax advisor professional that enables the client customer to comply with local, state, and national governmental tax schemes. YOU ARE SOLELY RESPONSIBLE FOR YOUR TAX SETTINGS. TAX RATES, NAMING CONVENTIONS AND THE ORDER OF OPERATION FOR THOSE RATES VARY BY JURISDICTION AND ARE SUBJECT TO CHANGE. YOU AND YOUR TAX PROFESSIONAL ARE RESPONSIBLE FOR REVIEWING, UPDATING, AND APPLYING THE SPECIFIC TAX SETTINGS, RATES AND THE ORDER OF OPERATION FOR YOUR SERVICE AREA(S). THE COLLECTION, RETENTION, AND PAYMENT OF APPLICABLE TAX LIABILITIES TO APPROPRIATE AUTHORITIES IS YOUR SOLE RESPONSIBILITY. BLAZE® MAKES NO WARRANTY NOR REPRESENTATION THE TAX SETTINGS, RATES AND THE ORDER OF OPERATION YOU SELECT ARE APPROPRIATE AND CORRECT. YOU EXPRESSLY AGREE BLAZE® SHALL NOT HAVE ANY LIABILITY FOR UNDER OR OVERCOLLECTION OF YOUR TAX LIABILITIES BASED UPON THE SETTINGS YOU SELECT.