This support article will show the changes that will be in place on January 1, 2023, to comply with the California Tax and Delivery Updates.

Please consult with your Tax Professionals when configuring BLAZE to your specific needs.

OVERVIEW

- 2022 California Tax Options

- 2023 California Tax Options

- Manage Receipts

- Product Profile Changes

- Vendor Profile Changes

- Excise Tax Paid in 2022 on Products Sold in 2023 Report

- Delivery Manifest

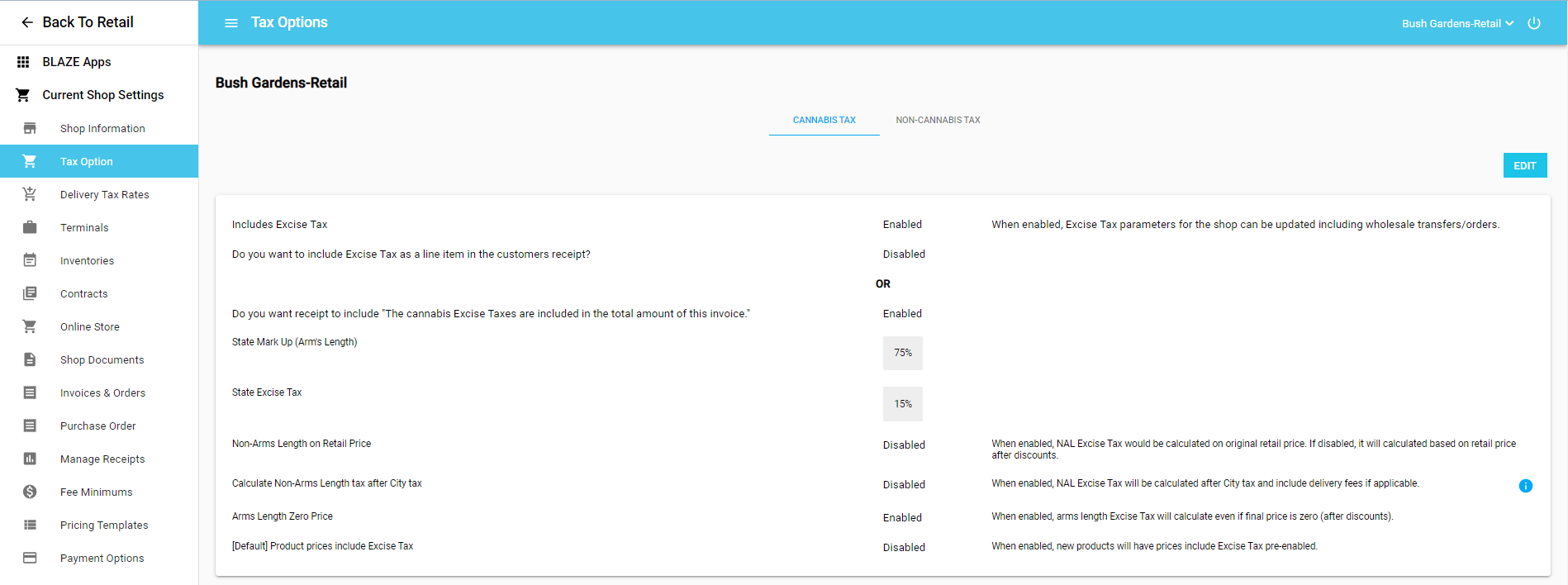

2022 California Tax Options

Notice on the screenshot below, that there is a reference to the Arm's Length and Non-Arms Length calculation of the Excise Tax. These are the Tax options in BLAZE for the years 2022 and prior.

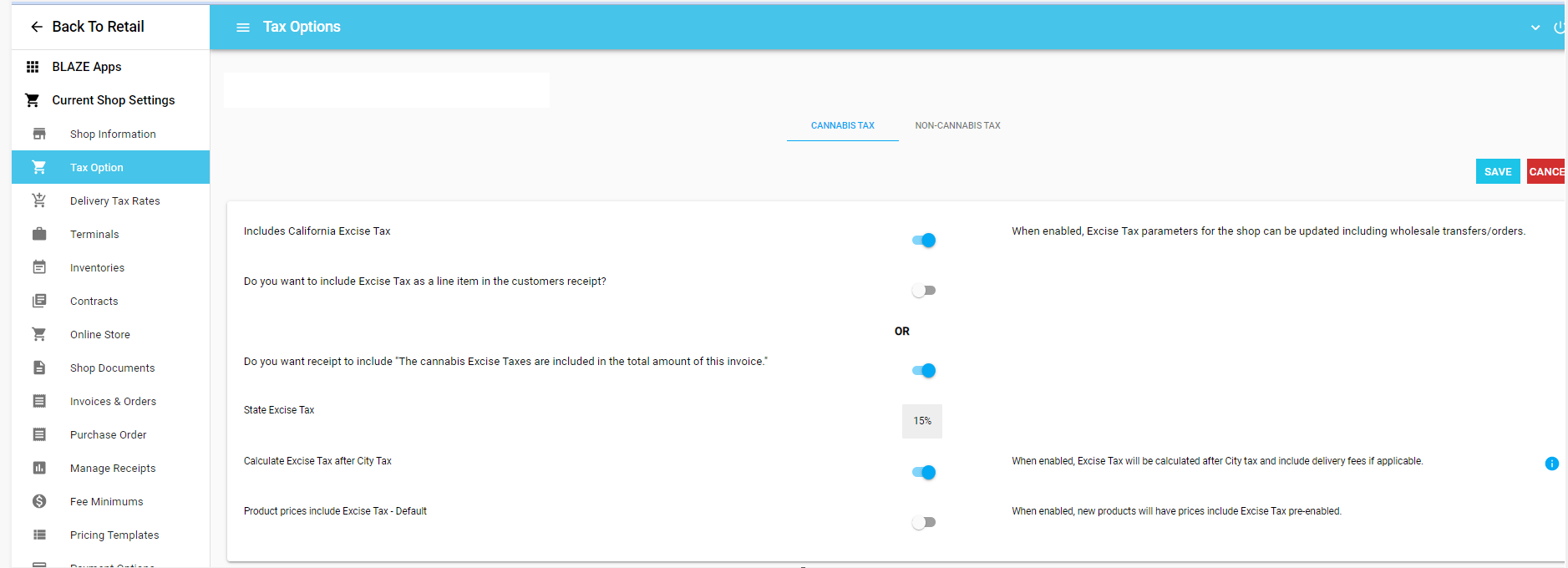

2023 California Tax Options

The Arms-Length and Non-Arm's Length references have been removed. Excise taxes are now calculated as a flat 15%. See the California Tax Option support article to walk you through the Tax options.

Requirements by the State of California:

- Include California Excise Tax must be enabled to calculate the 15% Excise Tax.

- Excise Tax must be included on the customer's receipt.

- Excise Tax must be calculated after the City Tax. This means that the Excise tax will be calculated on the Retail Value, less any discounts, plus the City Tax.

Manage Receipt Settings

You will need to ensure that Excise Tax is enabled to show on all your customer receipts. This would be for the Walk-Ins and Delivery. The Manage Receipt Settings support article can walk you through all of the available settings.

Global Settings > Current Shop Settings > Manage Receipts

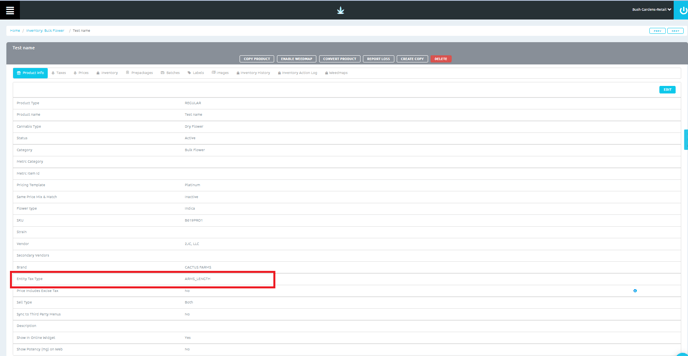

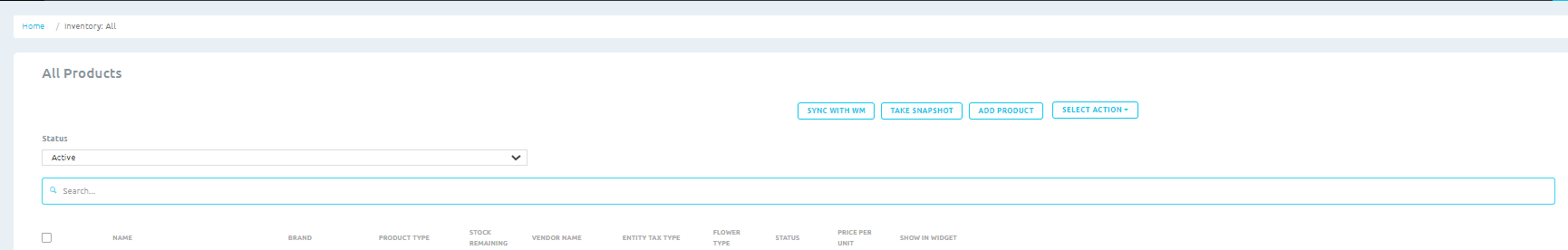

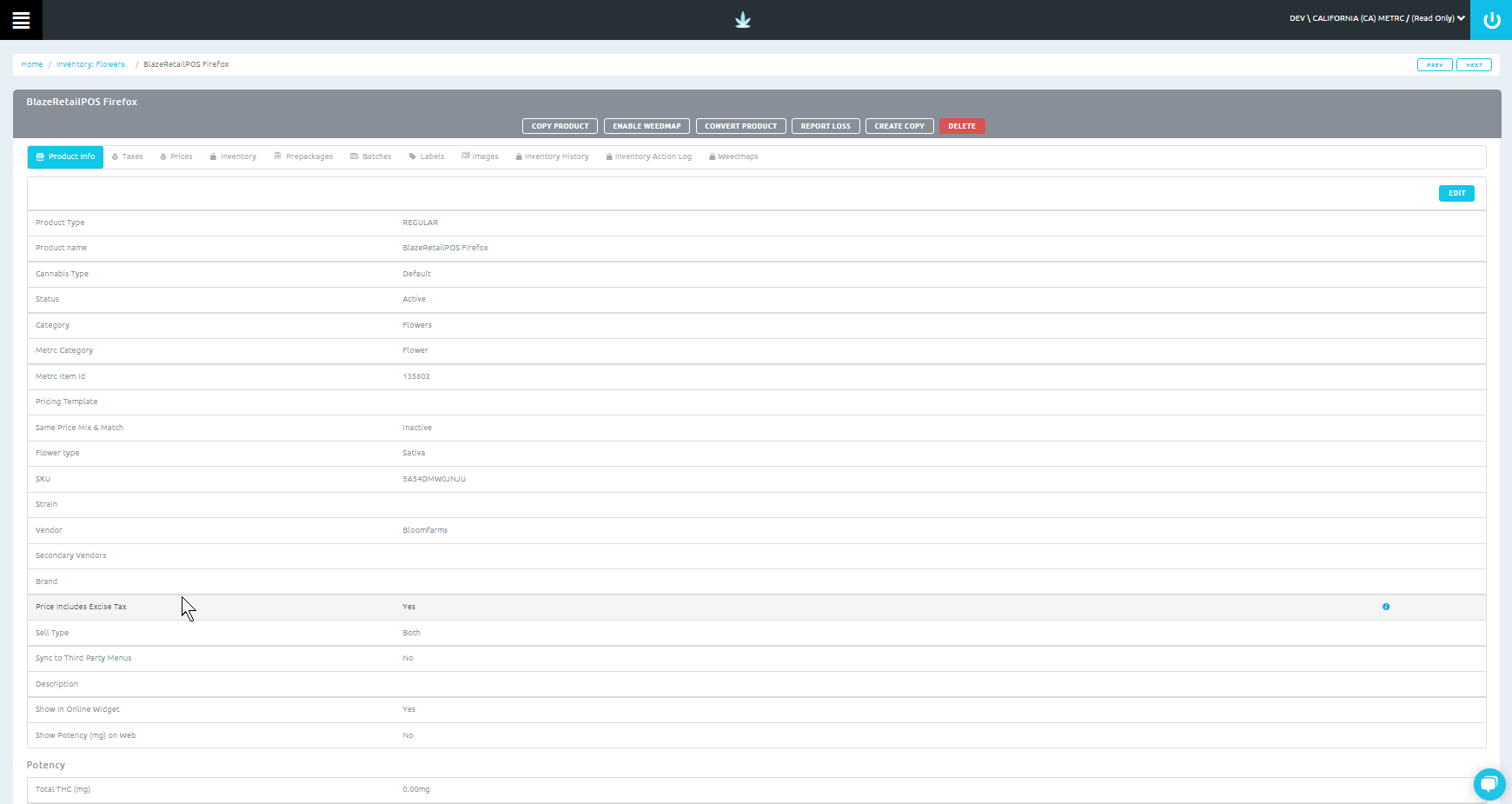

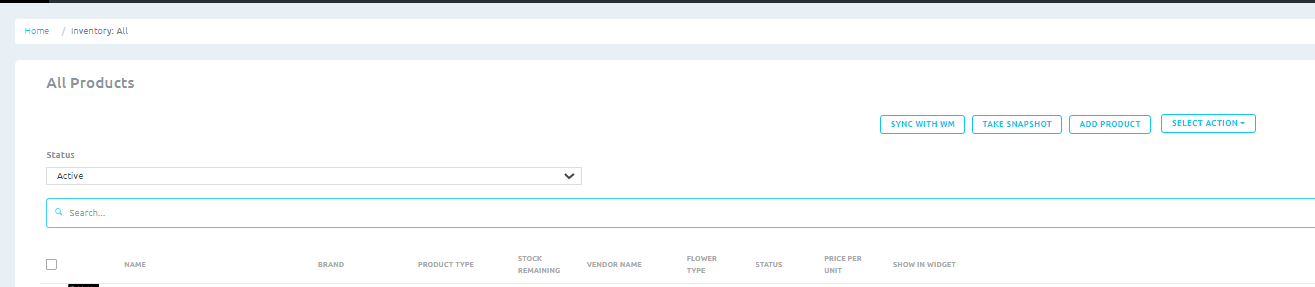

Product Profile Changes

The Entity Tax Type will be removed from the product profile and associated product views.

Old

New

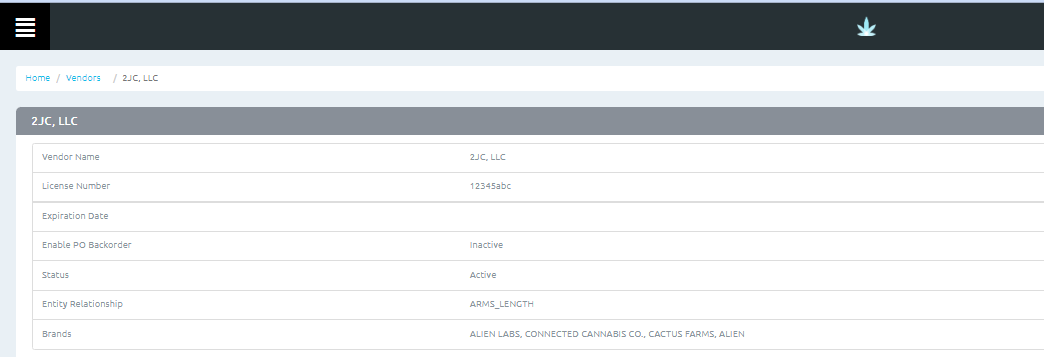

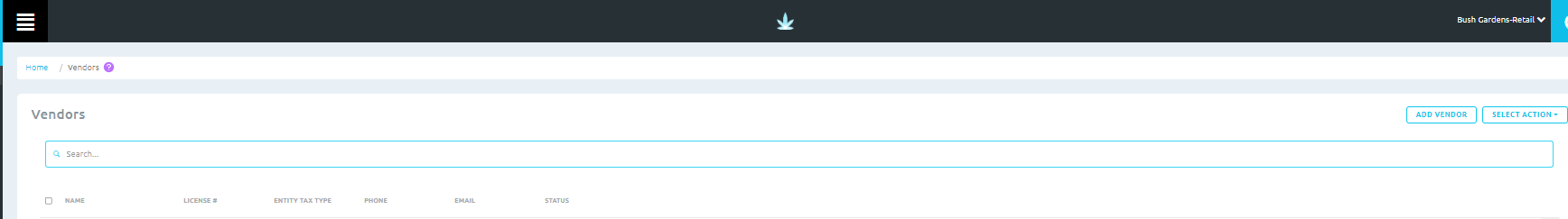

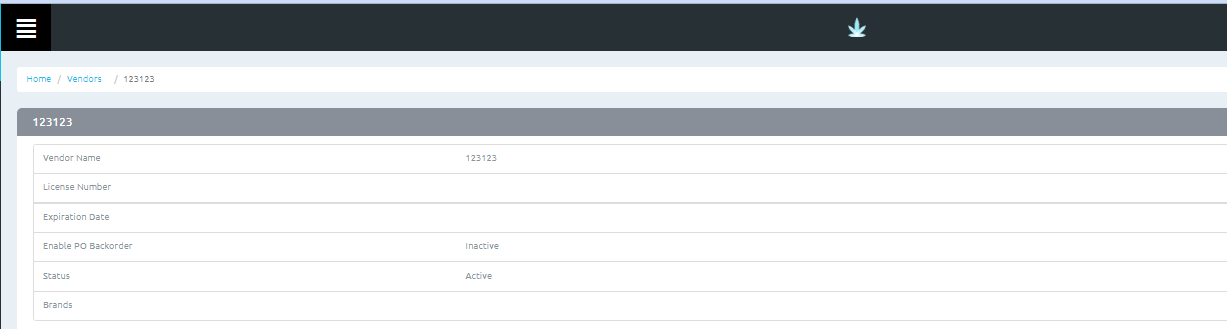

Vendor Profile Changes

The Entity Tax Type will be removed from the vendor profile and associated vendor views.

Old

New

Excise Tax Paid in 2022 on Products Sold in 2023 Report

This report will show you the excise tax that may have been paid in 2022 on products sold in 2023. And will assist you in determining if you can apply for a credit for these excise taxes.

- Data Export > Compliance > California 2023 Excise Tax Report

- Enter the date range From and To

- Click Continue

- Click on the Refresh Generated Section Button

- Click on the Generated tab

- Click on Download to open the CSV file

- The following columns are in this CSV file excise_tax_credit_report_starting date _ ending date.csv

- Shop

- Distributor

- Distributor License Number

- Product

- Product SKU

- Unique Id

- Track and Trace Id

- Batch Purchase Date

- Batch Receive Date

- Unit Excise Cost

- Batch Excise Cost

- Units Sold

- Pre AL Excise Tax

- Post AL Excise Tax

- Net Revenue

- Purchase Quantity

- Current Quantity

Delivery Manifest / Delivery Ledger

The delivery manifest/ledger is a requirement in California beginning January 1, 2023.

Retail delivery drivers must follow a workflow where they start their cash drawer when they leave the facility and close their cash drawer upon return. Each driver must have their own inventory and terminal.

The Delivery Ledger support article will walk you through viewing and printing the Delivery Ledger / Manifest.

If you have further questions, please reach out to us at support@blaze.me!

***Always consult a Professional / CPA / Attorney before setting/changing your taxes ***

BLAZE® is a complex and sophisticated SaaS platform that provides a series of individual tax settings for each client customer, subject to the advice of their tax advisor professional that enables the client customer to comply with local, state, and national government tax schemes. YOU ARE SOLELY RESPONSIBLE FOR YOUR TAX SETTINGS. TAX RATES, NAMING CONVENTIONS, AND OPERATION ORDER FOR THOSE RATES VARY BY JURISDICTION AND ARE SUBJECT TO CHANGE. YOU AND YOUR TAX PROFESSIONAL ARE RESPONSIBLE FOR REVIEWING, UPDATING, AND APPLYING THE SPECIFIC TAX SETTINGS, RATES, AND THE ORDER OF OPERATION FOR YOUR SERVICE AREA(S). THE COLLECTION, RETENTION, AND PAYMENT OF APPLICABLE TAX LIABILITIES TO APPROPRIATE AUTHORITIES IS YOUR SOLE RESPONSIBILITY. BLAZE® MAKES NO WARRANTY NOR REPRESENTATION THE TAX SETTINGS, RATES, AND THE ORDER OF OPERATION YOU SELECT ARE APPROPRIATE AND CORRECT. YOU EXPRESSLY AGREE BLAZE® SHALL NOT HAVE ANY LIABILITY FOR UNDER OR OVERCOLLECTION OF YOUR TAX LIABILITIES BASED UPON THE SETTINGS YOU SELECT.